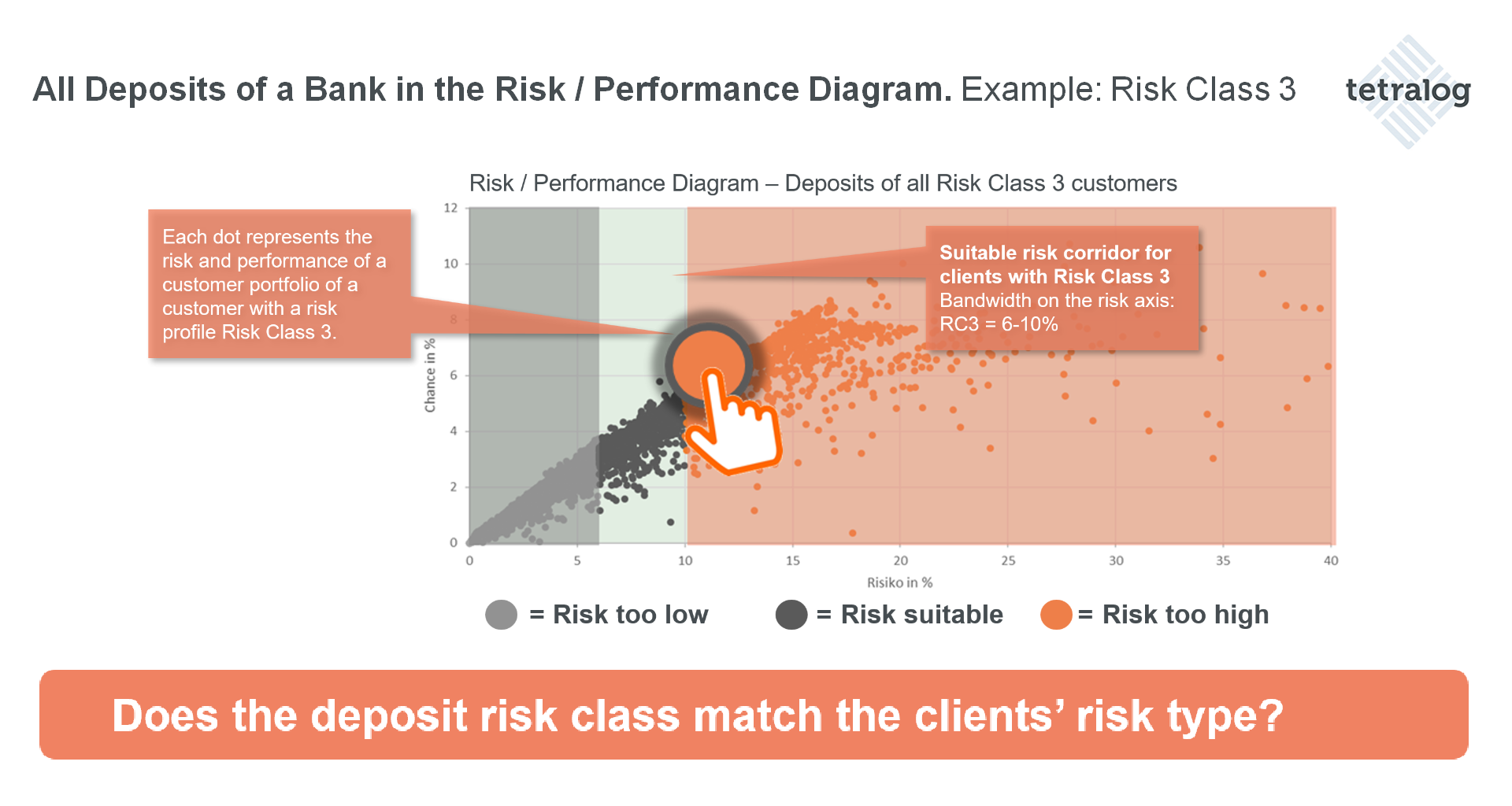

The illustration shows all securities accounts of a bank. Only custody accounts that have not been advised for several years are shown. The highlighted custody account lies outside the risk corridor (RK3) in which it should lie. The reallocations necessary to reach the correct corridor in each case are calculated in a potential analysis.

Source: Own calculations.

Analyses of Potential Show Advisory Potential

As an outsourcing partner and software solution provider to premium wealth managers, we know how regulation-compliant advice works. While financial advisory applications provide advice for individual portfolios, the new analysis of business potential looks at the entire customer base.

The analysis of business potential calculates the necessary and compliant reallocations in order to bring the portfolios that have slided of the appropriate risk corridor back into the range that has been agreed with the customers.

The participating banks can use the results to show their clients suitable suggestions to improve their portfolios. We call this systematic investment advisory, because campaigns and service models can be established in a regulation-proof manner and in line with the bank’s own market view. tetralog supports the whole process and provides calculations, data, process expertise and best practice experience.

Added value of an analysis of business potential by tetralog

- Systematic investment advice across the entire customer base

- Algorithms that used to be considered complicated (Markowitz) are now an integral part of holistic advice

- Considerable improvement in the quality of advice

- Client satisfaction is increased

- Regulation- and audit-proof

- Data protection compliant transfer of your customer data to tetralog systems

- Your products are the central element of the advisory service

- Process competence and best practice experiences

- Optional direct marketing package for your campaigns (direct mailing response rate up to 50%)

As input we only need the following data in a table:

- Portfolio ID

- ISINs

- Current values of the positions (alternative: quantity)

- Risk classes of the portfolios

- Optional: Cash accounts

Do You Know the Untapped Business Potential of Your Customer Base?

Digitalisation is now. We recommend ourselves as your travel companion with a analysis of business potential of your entire customer base. Explore new possibilities of customer development with us and use newly gained insights for more success in consulting and sales. On request, we also support advisors and investors with dynamic visualizations and intelligent assistance in raising the business potential. Suitable instruments are available for every banking channel. In addition to overall portfolio analyses, these include end-customer tools and advisory solutions.

If you are interested into our analysis offering, please do not hesitate to contact us:

PS: Case studies, suggestions for a radical change of perspective in the banking business and further possibilities for collaboration, e.g. as part of a post-Corona Depotcheck media campaign, can also be found on our website and in our blog forward-finance.de.